Suez Canal Blockage – Impact on Trade & Supply Chains

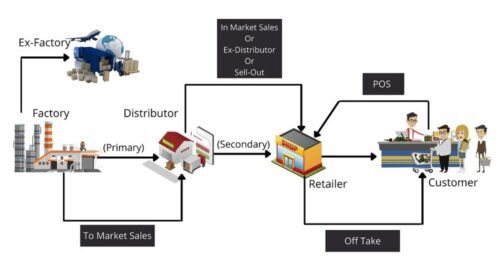

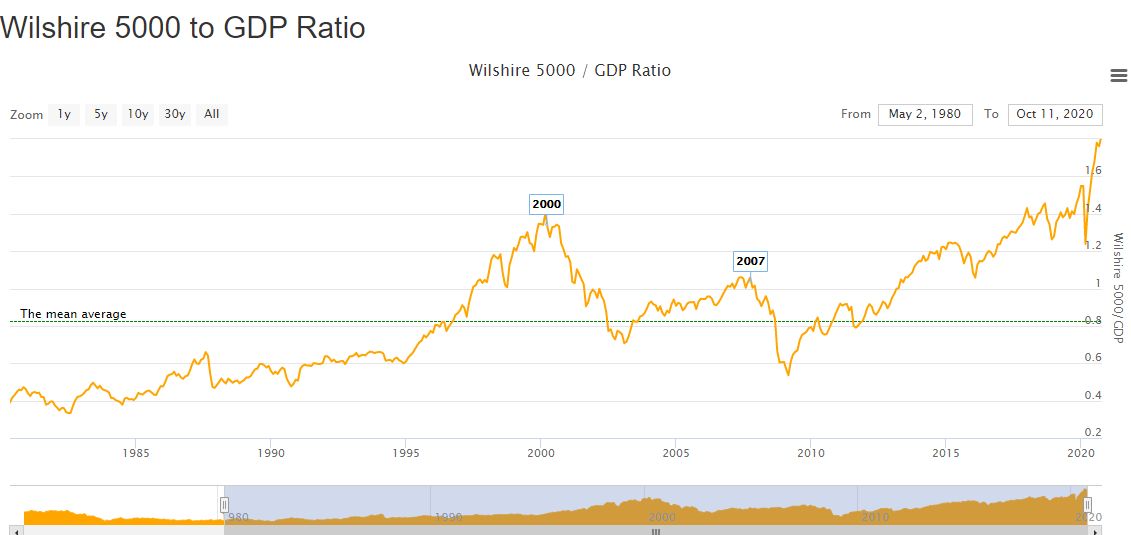

A year ago in May of 2020, Crude oil futures went negative to as low as -$37 a barrel. It actually meant people have to pay someone to take their oil. Are we looking at the opposite situation today? Will oil prices skyrocket given the block in the Suez Canal?

With the back-up at the suezcanal and the jam, the price of some traded goods may go up and perhaps result in a short supply of certain products. It may have an effect on Oil tanker rates after the jam clears. $FRO stock price already ticked up.

US imports more than a million barrels from OPEC. Canada and local US producers need to hike up production frenetically to make up for this shortfall. With active rigs not in full recovery mode, it is doubtful if we can make up this shortfall in a short time. Are we in for a sharp spike in WTI prices until the jam clears?

As far as Brent is concerned, will there be oversupply as the Oil is stuck locally within the production regions and not finding a way to the largest Oil consumer in the world? Impact to be seen.

Are we looking at a $150 WTI Price this summer?